Ever stared at your payslip, baffled by where a huge chunk of your hard-earned salary just vanished? For most Kiwis, that confusing line item for PAYE (Pay As You Earn) tax feels like a frustrating loss-money you’ll never see again. It’s the very definition of trading your valuable time for a shrinking paycheck, keeping you stuck on the corporate ladder and far from your financial goals.

But what if you could reframe that thinking? What if understanding your payslip was the first, critical step to building a property empire? This guide is your playbook. We’re breaking down exactly how your take-home pay is calculated so you can feel in complete control. More importantly, we’ll show you the proven framework to leverage that salary, create a rock-solid savings plan, and map your journey from employee to a strategic Property CEO. It’s time to stop feeling stuck and start making your income work for you.

What is PAYE? A Simple Guide for Aspiring Property CEOs

Before you build a property empire, you must first master your own payslip. For many busy professionals, it’s a document you glance at, but don’t truly understand. That stops today. Think of your payslip not as a record of the past, but as the launchpad for your future wealth. The biggest deduction you’ll see is PAYE, which stands for Pay As You Earn. It isn’t a separate tax; it’s simply the system New Zealand uses to collect income tax directly from your salary. Mastering this is your first step to stop trading time for money.

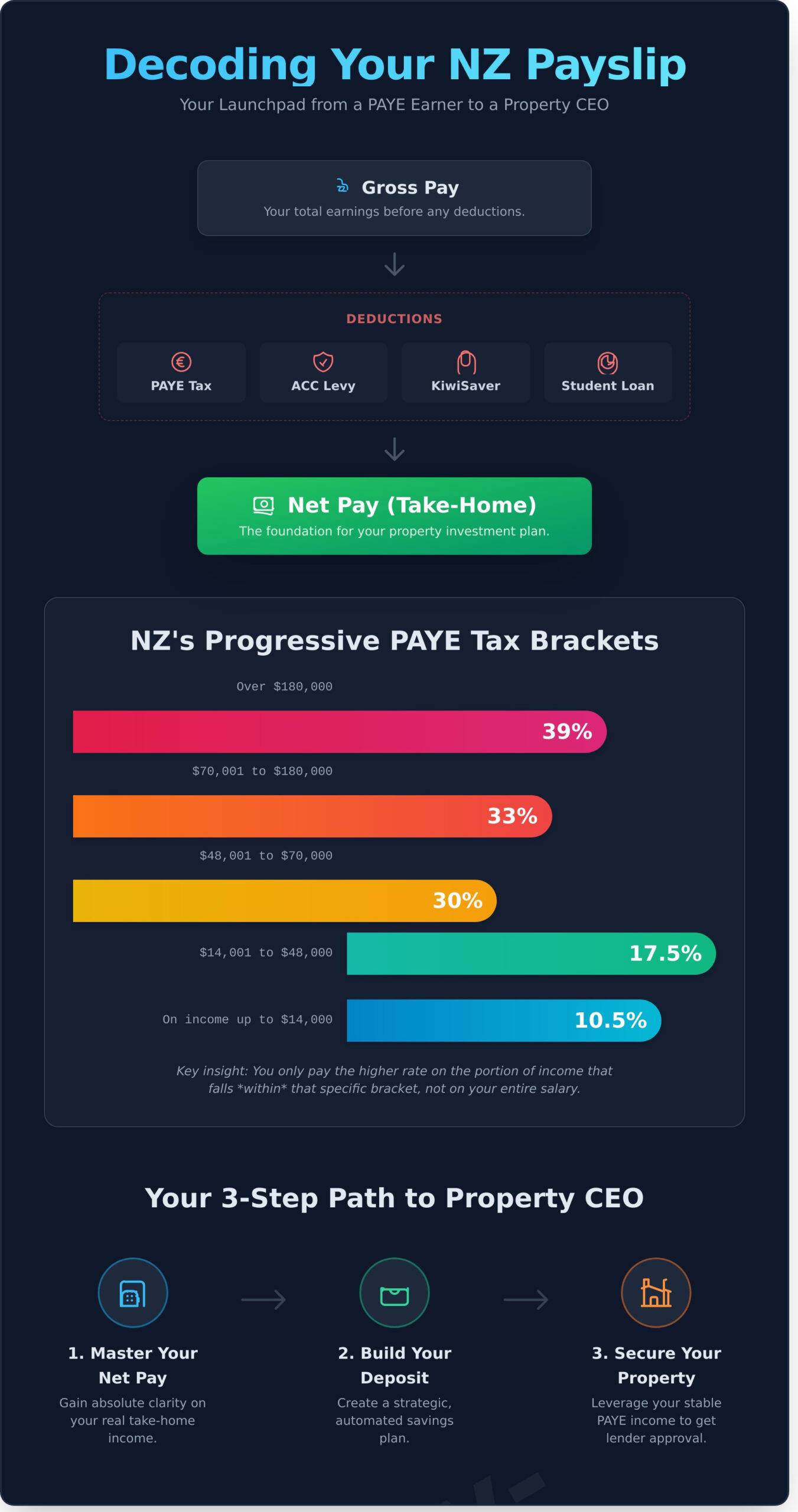

Decoding Your Payslip: The Key Components

Your payslip tells a story of where your money goes before it even hits your bank account. Understanding these numbers is non-negotiable for a future Property CEO. Here’s the playbook:

- Gross Pay vs. Net Pay: Gross pay is the total amount you earned. Net pay is what’s left after all deductions-this is your real take-home pay and the number you must use for budgeting.

- PAYE: This is the income tax portion, calculated based on how much you earn. It’s your contribution to public services.

- ACC Earners’ Levy: A small percentage that funds ACC, providing no-fault personal injury cover for everyone in NZ.

- KiwiSaver & Student Loan: These are your future (KiwiSaver) and your past (Student Loan). Both are deducted automatically, impacting your cashflow today.

NZ’s PAYE Tax Brackets: How Your Income is Taxed

New Zealand uses a progressive tax system. This doesn’t mean you get taxed at one single rate. Instead, different parts of your income are taxed at different rates. As your income increases, only the portion in the higher bracket gets taxed at the higher rate. This is a core part of the global Pay-as-you-earn (PAYE) system designed to be fair. For most people with one job, your tax code will be ‘M’, which tells your employer to use these standard rates:

- 10.5% on income up to NZ$14,000

- 17.5% on income from NZ$14,001 to NZ$48,000

- 30% on income from NZ$48,001 to NZ$70,000

- 33% on income from NZ$70,001 to NZ$180,000

- 39% on income over NZ$180,000

Why Understanding This is Your First Step to Financial Freedom

You cannot manage what you don’t measure. Getting absolute clarity on your net income is the foundation of every successful property investment plan. It’s how you build a rock-solid budget, create a strategic savings plan for your first deposit, and confidently approach a bank for a mortgage. When you talk to a lender, they speak in the language of net income and financial discipline. Master your payslip, and you’ll start speaking their language-the language of a CEO.

How Your PAYE Income Impacts Your Property Investment Potential

You now understand the mechanics of PAYE in NZ. But that knowledge is useless without a plan. Many busy professionals see their payslip as a ceiling-a fixed limit on their wealth. We see it as a launchpad. Your current job isn’t a trap; it’s the stable, predictable foundation you will use to build your property portfolio and achieve true financial independence.

Stop seeing your salary as just a way to pay bills. Start seeing it as the fuel for your investment engine. Here’s how to connect the dots from your payslip to your first property deal.

Calculating Your True Borrowing Power from Your Net Pay

When you walk into a bank, they aren’t interested in your gross salary. They care about your net pay-the actual cash that hits your account after tax. This figure is the cornerstone of their serviceability calculation, which determines how much they’ll lend you, often guided by a Debt-to-Income (DTI) ratio. The great news is that your consistent paye income is a massive green flag for lenders. While your employer handles your official PAYE obligations with the IRD, banks see that reliability as proof you can service a mortgage. This stability is your single greatest asset when starting out.

Want to see how your income translates to a property plan? Book a free strategy call.

Building Your Deposit: A Budgeting Plan for PAYE Earners

A loan approval is useless without a deposit. Building one on a salary requires CEO-level discipline, but it’s simpler than you think. It’s not about sacrifice; it’s about strategy.

- Know Your Numbers: Calculate your exact monthly take-home pay, down to the last dollar.

- Set a Non-Negotiable Target: Commit to saving a specific percentage, like 20% of your net income, before you pay any other bills.

- Automate Everything: Set up an automatic transfer to a separate, high-interest savings account for the day you get paid. Don’t give yourself the chance to spend it.

This isn’t just saving. This is your first act as a Property CEO-actively directing capital towards your goals.

Does PAYE Apply to Rental Income?

So, what happens when your portfolio starts generating its own income? The answer is simple: rental income is not taxed through the paye system. It is treated as business income, which you declare in your end-of-year tax return. This is a critical mindset shift. It marks your transition from being just an employee to an investor who manages multiple income streams. Understanding this distinction is fundamental to scaling your wealth beyond a single salary.

Leveraging Your Salary to Secure Your First Investment Deal

You’ve seen the deductions on your payslip and understand the system. Now it’s time for the critical mindset shift. That reliable salary isn’t just for paying bills and taxes-it’s the single most powerful asset you have to launch your property investment journey. It’s time to stop thinking like an employee and start acting like a CEO.

Your 9-to-5 isn’t a trap; it’s your launchpad. The financial stability it provides is exactly what lenders want to see. This section will show you how to leverage that stability to secure your first deal and begin building real wealth.

Making Your PAYE Income Attractive to Lenders

When you walk into a bank, lenders see one thing above all else: consistency. Your steady, predictable paye income is the ultimate proof of your ability to service a loan. It’s not about being a millionaire overnight; it’s about demonstrating reliability. This is your unfair advantage.

- Consistency is King: A solid history of employment, backed by regular payslips, shows lenders you are a low-risk borrower.

- Present with Confidence: Keep your financial records clean. Have your employment contract, recent payslips, and a clear bank statement history ready to go.

- Protect Your Credit: Your stable income must be paired with a clean credit history. Pay your bills on time, every time. This non-negotiable step proves you are financially responsible.

Your job is the bedrock. Use it to build your property empire.

The Mindset Shift: From Earning a Salary to Building Assets

This is where everything changes. Stop seeing your salary as the end goal. See it as the fuel for your investment engine. The very system that deducts your PAYE (pay as you earn) is the same one that provides lenders with the validated proof they need to back your first deal.

A Property CEO doesn’t just work for their income; they deploy their income to acquire assets that generate more income. This is the fundamental principle of escaping the rat race. Your salary becomes the seed capital to buy a property that pays you through rent or capital gains.

This principle extends beyond property; it’s about building systems that work for you. In the tech world, for instance, the Robots Project explores how automation can create assets that operate independently, a concept every future CEO should understand.

You have the income. You have the stability. The only thing missing is the strategy to make it work for you. It’s time to stop trading time for money and start building a portfolio that delivers financial freedom. To see the exact frameworks busy Kiwi professionals are using, visit property-ceo.com.

Beyond PAYE: Structuring Your Investments for Future Growth

Your first property deal is a massive milestone. But it’s just the beginning. To build real wealth and replace your salary, you need to move beyond the mindset of an employee. Your financial world is no longer just about your weekly paye deductions; it’s about active portfolio management. This is where you transition from earner to owner-from employee to Property CEO.

Tax on Property Flips vs. Long-Term Rentals

Your strategy dictates your tax. In New Zealand, the bright-line property rule means if you sell a residential investment property within a set timeframe, any profit is likely to be taxed as income. This heavily impacts a “flipping” strategy. In contrast, a long-term rental strategy focuses on taxing annual rental profit. Different goals, different structures, and vastly different tax outcomes. A clear plan isn’t a “nice-to-have”-it’s essential for protecting your profits.

Working with the Right Team: Your Accountant and Coach

Disclaimer: This article provides information, not financial advice. As your portfolio grows, you can’t do it all. A great accountant is non-negotiable; they will structure your affairs to manage tax obligations efficiently. But an accountant executes the plan-they don’t create it. That’s where a coach comes in. At Property-CEO, we provide the strategic playbook. We help you build the wealth creation plan that your accountant can then implement, ensuring your team is aligned to get you from your day job to financial freedom.

Your Next Step from PAYE Earner to Property CEO

The path is clearer than you think. You start by understanding your payslip and the power of your stable income. You then leverage that income to secure your first investment. Finally, you build a team and a system to scale your portfolio and create cash on demand.

This isn’t a dream reserved for the already wealthy. Financial freedom is achievable for busy Kiwi professionals who are tired of trading time for money. The only things you need are a proven system and expert guidance to accelerate your journey from a paye earner to the CEO of your own property empire.

Ready to build your plan? Take the first step with a free, no-obligation strategy call.

From PAYE Earner to Property CEO: Your Next Step

Understanding your payslip is more than just an exercise in compliance; it’s the launchpad for your entire investment journey. Your salary isn’t a ceiling-it’s the critical leverage you need to secure that first deal and begin building real wealth. The ultimate goal is to strategically transition from relying on your paye income to creating a property portfolio that works for you, not the other way around.

But theory alone won’t build an empire. To make the leap from employee to CEO, you need a proven playbook and guidance from people who have actually done the deals. Join our community of over 250+ ambitious Kiwi investors who have already completed over $100M in property deals. We provide real-world strategy, not just classroom theory.

Stop trading time for money. Start creating your future. Ready to build a life beyond the payslip? Request a Free Strategy Call. Your journey to financial freedom starts now.

Frequently Asked Questions About PAYE

What is the difference between PAYE and income tax in New Zealand?

Think of it like this: PAYE is the system, and income tax is the result. PAYE (Pay As You Earn) is the process employers use to deduct tax directly from your salary each payday. Income tax is the total tax you’re liable for on all your earnings at the end of the financial year. As a future Property CEO, mastering this distinction is the first step to taking full control of your cash flow and financial future.

How are bonuses or lump sum payments taxed under the PAYE system?

Lump sum payments like bonuses are taxed differently to ensure you don’t get a surprise tax bill. They’re taxed at a flat rate based on your total annual income. For example, if your total earnings are between NZ$70,001 and NZ$180,000, your bonus is taxed at 33%. Knowing these rates under the PAYE system is crucial for forecasting the real cash you’ll have available to invest. Plan your capital allocation with precision.

Can I reduce the amount of PAYE I pay on my salary?

You can’t arbitrarily lower your tax, but you can optimise it. The smart move is to ensure you’re on the correct tax code and claiming all eligible tax credits, such as those for donations. For a Property CEO, this isn’t about tax avoidance; it’s about financial efficiency. A tailored tax rate from IRD can also apply if you have predictable losses from other ventures, freeing up cash flow for your next deal.

How does having a secondary job or side hustle affect my PAYE?

When you’re building your empire with a side hustle, you must use a secondary tax code. This code withholds tax at a higher, flat rate on that second income stream to prevent a massive tax bill that could derail your investment plans. This isn’t a penalty; it’s a strategic move to ensure your tax obligations are met as you scale your income. Get this right from day one to maintain your financial momentum.

What happens if my employer deducts the wrong amount of PAYE?

As the CEO of your finances, you are ultimately responsible. If your employer under-deducts PAYE, you’ll face a tax bill from IRD-a cash flow hit you can’t afford. If they over-deduct, you’ve given the government an interest-free loan. Neither is optimal. Regularly check your payslip against IRD’s calculators. Take control and ensure your money is where it should be: in your hands, ready to be deployed for your next investment.

Does my KiwiSaver contribution rate change my PAYE tax?

No, your KiwiSaver contribution has zero impact on your PAYE calculation. This is a critical distinction. KiwiSaver is deducted from your pay *after* tax has already been taken out. Your tax is calculated on your gross salary, and then your KiwiSaver contribution is made from the net amount. Understanding this flow is essential for accurately forecasting your take-home pay and the capital you have to build your portfolio.