Is that nagging feeling keeping you up at night? The one that wonders if you’re leaving thousands on the table with the IRD, or if your current portfolio structure is a ticking time bomb. For too many ambitious Kiwi investors, a general-purpose accountant means missed opportunities and unnecessary risk. They don’t speak the language of LTCs, bright-line tests, and strategic depreciation. This isn’t just about filing a tax return; it’s about building an empire, and you need a specialist in your corner.

Hiring a dedicated property accountant in Auckland is one of the most powerful strategic moves you can make. It’s the difference between being a stressed landlord and the confident CEO of your financial future. This guide cuts through the noise. We’ll show you exactly how to identify a true property specialist, the critical questions you must ask, and how to find a partner who will help you legally minimise your tax, optimise your structure for growth, and scale your portfolio with absolute confidence.

Why Your Standard Accountant is a Liability for Your Property Portfolio

Stop treating your accounting like a chore. A true Property CEO understands that the right accountant isn’t a cost centre-it’s a profit centre. Your family accountant is brilliant at PAYE and filing GST returns, but relying on them for your property portfolio is like asking a GP to perform specialist surgery. It’s a risk that could cost you tens of thousands of dollars in overpaid tax and missed opportunities.

New Zealand’s property landscape is a minefield of complex, ever-changing legislation. Think of the Bright-line test, interest deductibility rules, and the ring-fencing of rental losses. These aren’t just footnotes; they are wealth-defining rules that a skilled property accountant Auckland navigates daily. A specialist understands that the core functions of property management and investment accounting are deeply intertwined. Your family accountant, who doesn’t live and breathe this world, simply can’t offer the strategic foresight you need.

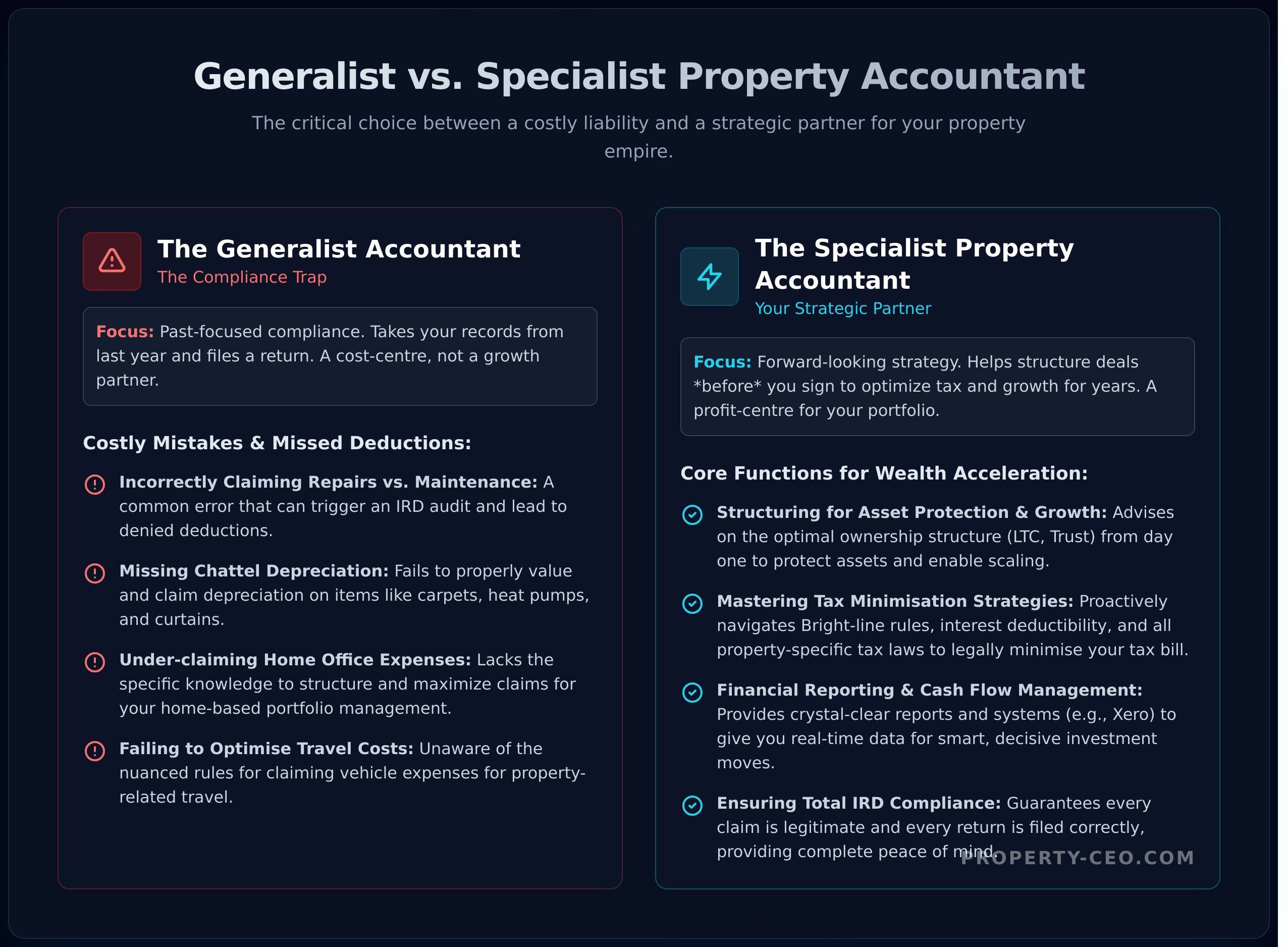

The Compliance Trap vs. Strategic Advice

Most general accountants operate in the past. They take your records and file last year’s tax return. This is pure compliance. A specialist property accountant Auckland provides forward-looking strategic advice. They help you structure the purchase of a new rental before you sign the agreement, ensuring optimal ownership structures (like a Trust or LTC) to legally minimise your tax bill for years to come. They turn defence into offence.

Commonly Missed Deductions by Generalists

The difference between a generalist and a specialist often lies in the details-details that add up to thousands in your pocket. Non-specialists frequently make costly errors, leaving your hard-earned money on the table for the IRD. Common mistakes include:

- Incorrectly claiming repairs vs. maintenance: A simple mistake that can trigger an audit and deny significant deductions.

- Missing chattel depreciation: Failing to properly value and depreciate items like carpets, curtains, and heat pumps.

- Under-claiming home office expenses: Not structuring your claims correctly for the portion of your home used to manage your portfolio.

- Failing to optimise travel costs: Not knowing the specific rules around claiming vehicle expenses for property viewings, inspections, and maintenance trips.

This isn’t just about filing taxes; it’s about building an empire. Your choice of property accountant Auckland will either accelerate your journey to financial freedom or hold you back. Choose wisely.

The Core Functions of a Top Auckland Property Accountant

Forget the stereotype of a back-office number-cruncher. A top-tier property accountant in Auckland is your financial co-pilot, a crucial strategist on your A-Team. Their mission isn’t just to file your returns; it’s to provide the clarity and strategy you need to scale your portfolio with total confidence. They are the expert who legally minimises your tax, maximises your cash flow, and helps you build lasting wealth, not just a collection of rentals.

Structuring for Asset Protection and Growth

Before you even make an offer, the most critical decision is your ownership structure. This isn’t just paperwork; it’s the foundation of your property empire. An expert will analyse your goals to determine the optimal structure-whether it’s a Look-Through Company (LTC), a trust, or holding it in your personal name. They’ll map out the pros and cons of each, ensuring your assets are protected while positioning you for maximum long-term growth. Getting this right from the start is a non-negotiable step in the process of Buying a rental or investment property.

Mastering Tax Minimisation Strategies

The New Zealand property tax landscape is complex and constantly shifting. A specialist property accountant is your guide through this minefield, focused on one primary outcome: ensuring you pay not a dollar more in tax than you legally have to. Their expertise is your advantage.

- Navigating Interest Deductibility: They provide clear, actionable advice on the phasing out of interest deductibility rules, helping you manage cash flow effectively.

- Bright-line Property Rule Advice: They help you plan strategically around the Bright-line rule to avoid nasty, unexpected tax bills when you decide to sell.

- Total IRD Compliance: They ensure every claim is legitimate and every return is filed correctly, giving you the peace of mind to focus on finding your next deal.

Financial Reporting and Cash Flow Management

You can’t operate as a Property CEO with messy spreadsheets. A great accountant provides crystal-clear financial reports that show the true performance of your portfolio at a glance. They move you from reactive bookkeeping to proactive financial strategy, helping you forecast cash flow for future acquisitions or renovations. By setting up efficient systems tailored for investors (like Xero), they give you the real-time data needed to make smart, decisive moves and accelerate your journey to financial freedom.

How to Find and Hire the Right Property Accountant in Auckland

Stop thinking of an accountant as an expense. Think of them as the CFO of your property empire. Hiring the right property accountant in Auckland isn’t about finding the cheapest option; it’s about securing the best value and expertise to protect your assets and accelerate your growth. This isn’t just compliance; they are a key executive who helps you execute the high-level Strategies For Success In Real Estate that separate amateurs from professionals. The process is straightforward: targeted research, sharp interviews, and rigorous credential checks.

Where to Look for a Specialist

Don’t waste time with generic searches. The fastest path to a high-calibre professional is through trusted networks. Ask for referrals from other successful property investors who are already getting results. Your mortgage broker and lawyer are also excellent sources, as they work with top-tier accountants daily. Finally, verify that any potential candidate is a member of Chartered Accountants Australia & New Zealand (CA ANZ)-this is your baseline for quality and professionalism.

Crucial Questions to Ask in the Interview

Your interview is not a casual chat; it’s a strategic assessment. You need direct answers that demonstrate real-world expertise. Get straight to the point with these questions:

- How many property investors do you currently work with, and can you describe the results you’ve helped them achieve?

- What specific strategies do you use to help clients navigate the Bright-line property test and current interest deductibility rules?

- Based on my goals, what ownership structure (e.g., LTC, trust) would you recommend, and what are the precise benefits and drawbacks?

- What is your fee structure? Are your fees fixed for predictable budgeting, or are they hourly?

Red Flags to Watch Out For

A weak advisor can cost you tens of thousands in missed opportunities and tax mistakes. Walk away immediately if you see these warning signs:

- They can’t clearly and simply explain complex, property-specific tax laws.

- They focus only on last year’s numbers and fail to ask about your long-term wealth creation goals.

- They promise aggressive or “too good to be true” tax schemes. This is a shortcut to an IRD audit.

- They are slow to respond or communicate poorly. A true professional partner is responsive and proactive.

Finding the right property accountant in Auckland is a critical step in building the professional team you need to scale. It’s the secret weapon that allows you to move faster and with more confidence. See how our members build their A-team and achieve financial freedom.

Beyond Accounting: Building Your Property CEO ‘A-Team’

Finding the right property accountant in Auckland is a critical first step. But it’s just that-the first step. Amateurs focus on one expert; successful Property CEOs build an entire ‘A-Team’. This is the team that provides the leverage you need to stop trading time for money and start building real wealth. Each expert plays a specific, non-negotiable role in finding, funding, and managing your deals at scale.

Your Core Team: The Big Four

Your success is determined by the quality of your advisors. These are the four essential experts you need on your side to accelerate your journey from busy professional to full-time investor:

- The Property Accountant: Your financial strategist. A specialist property accountant in Auckland does more than just file your taxes; they structure your portfolio for maximum growth and minimum liability, ensuring your empire is built on a rock-solid foundation.

- The Mortgage Broker: Your finance and funding specialist. A great broker navigates the complex NZ lending landscape to secure the capital you need to execute deals quickly and efficiently.

- The Lawyer: Your legal protection. They review contracts, manage settlements, and ensure every transaction is structured to protect your growing assets from unnecessary risk.

- The Property Coach/Mentor: Your overall guide and strategist. They are the CEO’s most trusted advisor, helping you build the master plan and holding you accountable to execute it.

How a Coach Amplifies Your Team’s Success

Your team of experts is powerful, but without a clear strategy, they’re just disconnected specialists. A great coach acts as the conductor of your orchestra, ensuring every professional works in perfect harmony towards your single goal: financial freedom.

They provide the overarching strategy and proven frameworks for your team to execute. They give you the system and accountability to ensure you’re taking consistent, massive action-not just talking about it. A coach also connects you with their own vetted network of professionals, fast-tracking your access to the best in the business.

Your accountant manages the numbers. We help you build the empire. If you’re ready to stop being a landlord and start being a Property CEO, it’s time to act.

Your A-Team Starts with the Right Financial Partner

Treating your portfolio like a serious business means moving beyond a standard accountant. The right specialist isn’t just a number-cruncher; they are a strategic partner who optimises your tax structure, maximises cash flow, and protects your assets. Finding the property accountant Auckland investors rely on is a non-negotiable step in building your wealth-creation A-Team and scaling your results.

But your accountant is just one player. To truly accelerate your journey, you need the full CEO playbook. Stop guessing with your finances. Book a Free Strategy Call to build your roadmap. Join a community of over 250 active Kiwi investors who have executed more than $100M in property deals, all with guidance from coaches who are in the market doing deals right now.

Your property empire won’t build itself. Take decisive action and start leading your portfolio like the CEO you are.

Frequently Asked Questions About Property Accountants

How much does a specialist property accountant cost in Auckland?

Stop thinking of it as a cost; it’s an investment in your portfolio’s performance. For a single rental, a specialist property accountant Auckland typically charges between NZ$800 and NZ$1,500 + GST annually. Portfolios with more complex structures like LTCs or trusts will be higher. The real question isn’t the price, but the value. A great accountant saves you more in tax and strategic advice than their fee, directly boosting your cashflow and accelerating your path to financial freedom.

Do I need a property accountant if I only have one rental property?

Absolutely. Amateur landlords try to save a few dollars by doing it themselves. Property CEOs understand that leverage is key-and that includes leveraging expert advice. Even with one property, the tax landscape is complex with rules around interest deductibility and depreciation. An expert ensures you claim every legal deduction, structure your ownership correctly from day one, and stay compliant. This isn’t a hobby; it’s the foundation of your wealth. Get professional support to match your ambition.

What’s the difference between a property accountant and a tax agent?

A tax agent is a compliance tool; they file your past tax returns correctly. A specialist property accountant is a strategic partner. They don’t just look backward-they help you plan forward. They’ll advise on optimal ownership structures, tax efficiency for future purchases, and strategies to maximise your cashflow and equity growth. A tax agent keeps you out of trouble with the IRD. A property accountant helps you build an empire.

Can a property accountant help me set up a Look-Through Company (LTC)?

Yes, and they are the only professional you should trust for this. Setting up an LTC isn’t just paperwork; it’s a critical strategic decision. A specialist will analyse your entire financial position to confirm if an LTC is the right vehicle for your goals. They handle the structuring, Companies Office registration, and IRD filings to ensure it’s done right from the start. Getting this wrong can cost you thousands in tax and lost opportunities. Don’t risk it.

What financial records do I need to give to my property accountant each year?

A true Property CEO has their systems dialed in. Annually, you’ll provide your accountant with clear, organised records. This typically includes full bank statements for all relevant accounts, loan statements showing interest paid, a summary of all rental income received, and a detailed list of all expenses-from rates and insurance to repairs and property management fees. The more organised you are, the more efficiently your accountant can work, saving you both time and money.

Is it better to choose an accountant with a fixed-fee or hourly rate?

We always advocate for fixed-fee agreements. This model gives you clarity and cost certainty, removing the fear of calling your accountant with a strategic question. It turns them into a true partner invested in your efficiency, not a clock-watcher billing for every minute. With hourly rates, you hesitate to seek advice-the exact opposite of what you need to scale your portfolio. Choose a partner who provides unlimited support, not a time-based vendor.