Your home has been quietly building wealth for years. The question is, are you going to let that power sit dormant, or are you ready to put it to work? For too many ambitious Kiwis, the dream of a property portfolio stalls right here. The fear of over-leveraging the family home, the confusing bank jargon, and the uncertainty of getting another loan approved creates a wall of hesitation. You know the opportunity is there, but the path forward is a minefield of risk and confusion.

Stop guessing. This is the Property CEO’s blueprint for using equity to buy another house in New Zealand. We are cutting through the noise to give you a clear, step-by-step playbook to unlock the hidden capital in your property. In this guide, you will learn exactly how to calculate your usable equity, speak the bank’s language with confidence, and strategically scale your portfolio from one property to an empire-without gambling your financial security. It’s time to stop trading time for money and start building real wealth.

What is Property Equity and Why is it Your Most Powerful Asset?

In your home sits your most powerful-and most overlooked-financial asset. It’s the wealth you’ve built, often silently, through rising property values and consistent mortgage payments. But for most Kiwis, this wealth is just ‘lazy money,’ sitting idle. The traditional path is to let it grow passively. The Property CEO path is to put it to work. Your home isn’t just a place to live; it’s the financial launchpad for your entire investment portfolio. Understanding how to unlock this power is the first critical step in using equity to buy another house and build real, lasting wealth.

Defining Usable Equity: What the Banks Will Actually Lend You

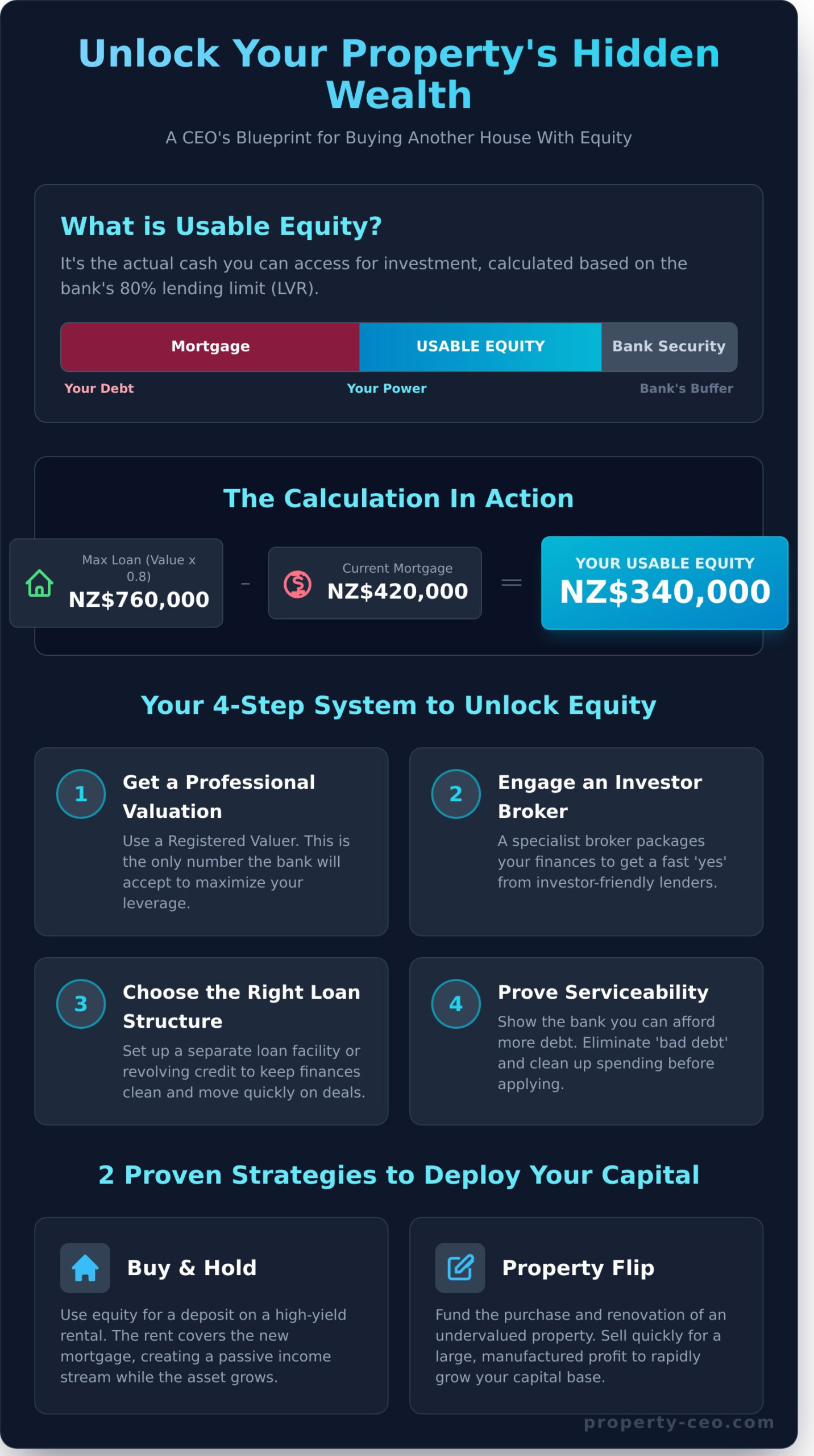

Your total equity is the market value of your home minus your mortgage balance. But banks won’t let you borrow against all of it. They use a metric called the Loan-to-Value Ratio (LVR) to manage their risk. For your own home in New Zealand, banks will typically lend up to 80% of its value. This 20% buffer is their security. The difference between this 80% threshold and your current mortgage is your usable equity-the actual cash you can access for investment.

Calculating Your Usable Equity: A Simple Formula

Stop guessing. The calculation is straightforward and empowers you to make decisions. Use this formula to find your exact number:

(Current Property Value x 0.80) – Current Mortgage Balance = Usable Equity

Let’s use a real-world Wellington example. Your home is now valued at NZ$950,000, and your remaining mortgage is NZ$420,000.

- (NZ$950,000 x 0.80) = NZ$760,000 (The maximum loan the bank allows against your home)

- NZ$760,000 – NZ$420,000 = NZ$340,000 (Your Usable Equity)

That NZ$340,000 is your deposit for your next investment property. It’s the key to your expansion.

The Mindset Shift: From Homeowner to Property CEO

This is where you stop thinking like a homeowner and start acting like a CEO. We’re taught that debt is bad, but that’s a dangerous oversimplification. A Property CEO understands the power of ‘good debt’-leveraging an asset to acquire another income-generating asset. While the technical definition of What is Property Equity is simple, its potential is massive. This isn’t just about buying a second property; it’s your first strategic move in building an empire. You are transforming lazy money into a cash-generating machine.

The Step-by-Step System for Unlocking Your Equity

Forget the confusing financial maze. The path to using your equity is a repeatable system-a playbook you can run again and again to scale your portfolio. Success isn’t about luck; it’s about preparation. Before you even think about talking to a bank, you need to assemble your expert team and get your strategy straight. This is how you move like a Property CEO.

Step 1: Get a Professional Property Valuation

Your council valuation (CV) is irrelevant. It’s a number for calculating rates, not for building your empire. To unlock maximum leverage, you need a current Registered Valuation from an accredited valuer. This is the real-world figure the bank will use to calculate your usable equity. A simple weekend spent on cosmetic touch-ups-a fresh coat of paint, tidying the garden-can often add significant value, directly increasing the funds you can access.

Step 2: Engage a Mortgage Broker Who Understands Investors

Going directly to your bank is an amateur move. A sharp mortgage broker who specialises in investment finance is your most critical ally. They don’t just find you a rate; they package your entire financial story to showcase your strength as a borrower. They know which lenders are investor-friendly right now and how to frame your application for a fast ‘yes’. Don’t settle for a generalist; find a broker who thinks like an investor.

Step 3: Choose the Right Loan Structure for Your Goals

How you access your equity matters. You can either top-up your existing home loan or, more strategically, set up a separate loan facility. This keeps your personal and investment finances clean. For advanced investors, a revolving credit facility acts like a pre-approved war chest, giving you the power to move fast on opportunities. Discussing interest-only options for the new investment loan can also be a smart move to maximise cash flow from day one.

Step 4: Proving Serviceability to the Bank

The bank has one key question: can you afford more debt? This is ‘serviceability’, often measured by a Debt-to-Income (DTI) ratio. They will scrutinise your income, living expenses, and existing debts, then factor in the potential rental income from the new property. To strengthen your position for using equity to buy another house, prepare in advance:

- Eliminate bad debt: Pay down or consolidate high-interest credit cards and personal loans.

- Clean up your accounts: Reduce discretionary spending in the months leading up to your application.

- Organise your documents: Have your pay slips, bank statements, and tax records ready to go.

3 Proven Strategies for Using Equity to Buy Your Next Property

You’ve done the hard work to unlock the capital sitting in your home. Now for the exciting part: putting that equity to work. This isn’t just about buying a second property; it’s about executing a proven strategy to build real wealth and finally stop trading your time for money. The right move now can create unstoppable momentum for your entire portfolio.

Here are three powerful playbooks used by successful Property CEOs.

Strategy 1: The Classic ‘Buy and Hold’ for Passive Income

This is the foundational wealth-building strategy. You use your equity as the full deposit on a high-yield rental property. For example, you could use $120,000 of equity to secure a $600,000 property in a strong New Zealand rental market. The goal is simple: the weekly rent covers the new mortgage, rates, and insurance, leaving you with positive cash flow. This creates a reliable, passive income stream while the asset grows in value over the long term.

Strategy 2: The High-Profit ‘Property Flip’

If you’re looking to create a large cash lump sum quickly, the property flip is your go-to move. Here, you’re using equity to buy another house that is undervalued, funding both the purchase and renovation. You find a tired home, add significant value through a smart, targeted renovation, and sell it for a substantial profit within months. This strategy is about manufacturing equity-forcing appreciation rather than waiting for it. It’s an active approach to create capital on demand.

Strategy 3: The BRRRR Method (Buy, Renovate, Rent, Refinance, Repeat)

For busy professionals who want to scale their portfolio like a business, the BRRRR method is the ultimate accelerator. This advanced strategy combines the best of the first two and puts your growth on hyperdrive:

- Buy: Use your equity for the deposit on an undervalued property.

- Renovate: Add value to increase its market price and rental return.

- Rent: Place a quality tenant to create immediate cash flow.

- Refinance: The bank revalues the property at its new, higher worth, allowing you to pull your initial investment back out, tax-free.

- Repeat: Use that same capital to fund your next deal.

Mastering this cycle is the key to building a multi-property portfolio without getting stuck waiting for more capital. It’s the exact framework we use to help everyday Kiwis achieve financial independence at Property-CEO.

The Risks of Using Equity and How a Property CEO Manages Them

Let’s be direct. Using leverage to build a property portfolio feels risky because it is. But the difference between an amateur and a Property CEO isn’t the absence of risk-it’s the presence of a system to manage it. Stop avoiding risk. Start controlling it.

Amateurs cross their fingers and hope for the best. A CEO builds a fortress around their assets and cash flow. Here’s how they manage the three biggest fears associated with using equity to buy another house.

Risk: Over-Leveraging Your Family Home

Putting your family home on the line is the number one fear for most aspiring investors. A Property CEO mitigates this by setting clear, non-negotiable boundaries. They never borrow the maximum amount available, always maintaining a healthy equity buffer as a critical safety net. Crucially, they use smart, separate loan structures to create a financial firewall between their personal home and their investment portfolio.

Risk: Interest Rate Increases and Cash Flow Strain

In New Zealand’s dynamic interest rate environment, cash flow is king. Before committing to a second property, a CEO stress-tests the numbers. What happens if mortgage rates climb to 8% or 9%? If the deal doesn’t generate positive cash flow at a higher rate, it’s a ‘no’. They also build a cash buffer-a separate account holding 3-6 months of mortgage payments for all properties-to handle any unexpected vacancies or cost increases without stress.

Risk: A Downturn in the Property Market

Market fluctuations are inevitable. While a downturn can reduce your equity on paper, it only becomes a real loss if you’re forced to sell. This is why a CEO’s strategy is never based on speculation or “timing the market.” Instead, the focus is on acquiring assets that produce strong rental income. Positive cash flow allows you to hold property through any cycle, turning market noise into a minor distraction while you build long-term wealth.

Managing these risks isn’t complex, but it does require a proven framework. Stop letting uncertainty dictate your financial future. Learn how to manage risk with a proven system. Talk to our team.

From Equity on Paper to a Property Empire

You now have the CEO’s blueprint. You’ve seen that your home equity isn’t just a passive number-it’s an active asset, ready to be deployed. We’ve walked through the step-by-step system for unlocking it and the proven strategies for using equity to buy another house without gambling your financial future. The difference between a hobbyist and a Property CEO is a repeatable plan for growth and risk management. You have the foundations of that plan right here.

But a blueprint is useless until you build. If you’re a busy professional ready to stop trading time for money, it’s time for action. Learn the systems behind over NZ$100M in successful property deals and get guidance from experienced, active property flippers who practice what they preach. Join our community of over 250 everyday Kiwis who are building real wealth right now. Ready to stop trading time for money? Request a Free Strategy Call.

Financial freedom isn’t a distant dream. It’s a series of strategic decisions, and your next one is right in front of you.

Frequently Asked Questions

Do I need cash savings in addition to using my equity?

Yes, absolutely. While using your equity is a powerful first step, banks need to see that you can manage risk. They will typically require a cash buffer to cover transaction costs like legal fees, valuations, and potential renovation expenses. Think of it as your operational capital. A true Property CEO doesn’t just rely on leverage; they maintain liquidity to seize opportunities and protect their growing empire from unexpected costs.

How does drawing equity affect my current mortgage payments?

Drawing equity increases your total loan amount, which means your total mortgage repayments will increase. You are essentially adding a new loan portion onto your existing one. The smart strategy is to ensure the rental income from your new investment property more than covers its own mortgage, rates, and insurance. The goal isn’t just to buy property; it’s to acquire a cashflow-positive asset that pays for itself and starts building your wealth immediately.

What’s the difference between a mortgage top-up and a revolving credit facility for investors?

A mortgage top-up is a standard loan with fixed principal and interest repayments. It’s structured and predictable. A revolving credit facility acts like a large overdraft secured against your home-you can draw down and repay funds as you wish, only paying interest on the amount you’ve used. For a Property CEO, a revolving facility offers incredible flexibility for funding deposits or quick renovations, but it demands strict financial discipline to manage effectively.

How quickly can I access my home equity in New Zealand?

The process is faster than you think, but it isn’t instant. Once you submit your application, you’ll need a property valuation and final bank approval. In New Zealand, this typically takes between two to four weeks from start to finish. The key to accelerating this is preparation. Having your proof of income, household budget, and investment strategy ready for the bank shows you are serious and organised, helping to fast-track your approval.

Will I have to pay a higher interest rate on the investment loan portion?

Yes, you should expect a slightly higher interest rate. New Zealand banks consider investment property loans to be a higher risk than owner-occupied mortgages, and their pricing reflects that. This is a standard cost of doing business and should be factored into your calculations. A solid strategy for using equity to buy another house ensures the deal still generates strong positive cashflow, even after accounting for this higher interest rate.

Can I use this strategy if I’m self-employed?

Absolutely. Being self-employed is not a barrier to building a property portfolio. However, you must be prepared to provide more comprehensive documentation to the bank. Lenders will typically want to see at least two years of full financial statements and tax returns to verify a stable and consistent income. This is simply about proving your business is a reliable source of cashflow, allowing you to secure the leverage you need to scale.