The single biggest mistake that stalls a property empire isn’t choosing the wrong house-it’s getting trapped by the wrong finance. When you’re comparing mortgage rates nz, a single misstep can lock you into a deal that drains your cash flow and slams the brakes on your ability to scale. You’re left on the sidelines, watching others build their portfolios while you’re stuck with a loan that works for the bank, not for your freedom.

But it’s time to stop being a rate-taker and start acting like a Property CEO. Securing the best deal isn’t just about finding the lowest number. It’s about building a strategic financial foundation-understanding leverage, maximising cash flow, and structuring your debt to accelerate your wealth creation, not hinder it.

This guide is your playbook. We cut through the bank jargon to show you exactly how to analyse and compare your options like a seasoned investor. You’ll learn to structure your loans for maximum flexibility, negotiate with confidence, and secure the funding that empowers you to buy that next deal. Stop guessing. Start building your empire.

Understanding the Battlefield: What Really Drives NZ Mortgage Rates?

Stop seeing mortgage rates as just numbers on a screen. To get the best deal, you need to treat this like a strategic battlefield. Understanding the forces that dictate the cost of borrowing is the first step to gaining control and building your property empire faster. This isn’t about luck; it’s about knowing the system so you can make it work for you.

The landscape of mortgage rates nz is shaped by powerful economic drivers. As a Property CEO, your job is to understand them, anticipate their moves, and position your portfolio for maximum advantage. It all starts with the biggest player on the field.

The Reserve Bank’s Role: The Official Cash Rate (OCR)

Think of the OCR as the foundational interest rate for New Zealand’s entire economy, set by the Reserve Bank of New Zealand (RBNZ). Its primary job is to control inflation. When the RBNZ raises the OCR, it’s a clear signal that borrowing costs are about to go up across the board. When it cuts the OCR, it’s trying to stimulate the economy by making money cheaper. For a savvy investor, every OCR announcement is a critical intel drop-it tells you which way the financial winds are about to blow.

Beyond the OCR: Bank Funding and Competition

The OCR is the benchmark, but it’s not the whole story. Banks are businesses that need to source money before they can lend it to you. Their own funding costs, influenced by both local and global markets, directly impact the rates they offer. Before you can master these variables, you need a rock-solid grasp on the fundamentals of what is a mortgage loan? and how its terms are structured.

Here’s what else is at play:

- Wholesale Swap Rates: For fixed-term loans, the key metric to watch is the ‘swap rate’. This is the rate banks pay to secure funding for a specific period (e.g., two or five years). This is why fixed rates can-and often do-move independently of the OCR.

- Fierce Competition: The major banks are in a constant battle for your business. This competition is your opportunity. It forces them to offer special fixed-term rates, discounts, and cashback deals to win market share. This is where a well-prepared applicant can negotiate from a position of strength.

Ultimately, global economic health, local competition, and the RBNZ’s strategy all combine to create the rates you see. Now that you understand the forces at play, you’re ready to build your plan of attack.

Fixed vs. Floating: The Strategic Choice for a Property CEO

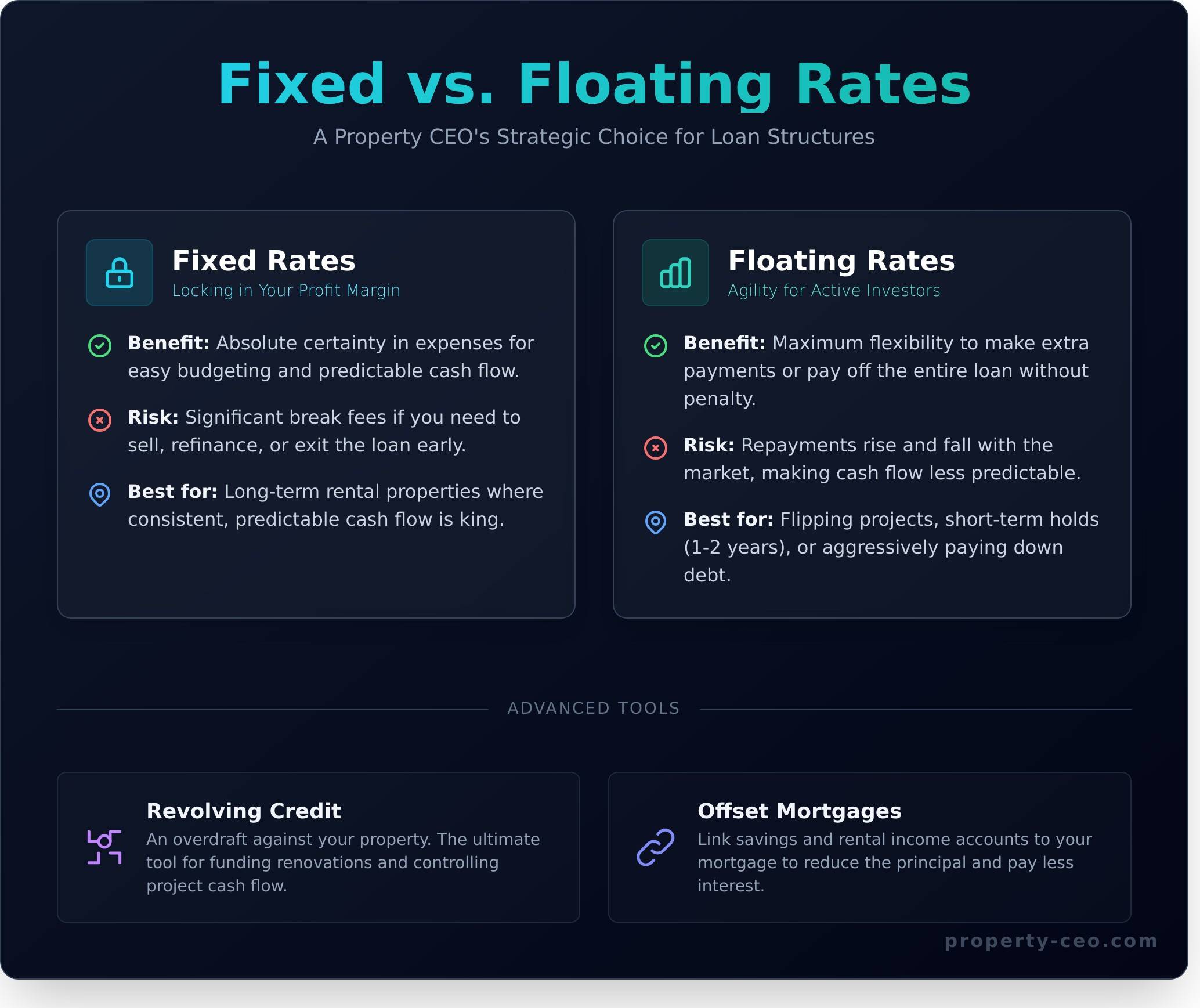

Stop thinking about your loan structure as a personal preference. For a Property CEO, it’s a strategic tool that dictates cash flow, manages risk, and directly impacts how fast you can scale your portfolio. The wrong choice ties up your capital and slows you down. The right choice creates momentum.

Your goal isn’t just to buy property; it’s to build a wealth-generating machine. This decision is one of your most important operational levers. Let’s break down the playbook.

Fixed Rates: Locking in Your Profit Margin

Certainty is control. A fixed rate locks in your mortgage payments for a set term (typically 1-5 years), making your expenses predictable. For a buy-and-hold rental property, this is non-negotiable. You can forecast your cash flow with precision, guaranteeing your profit margin month after month, regardless of market volatility. The risk? Inflexibility. If you need to sell or refinance early, bank break fees can cost you thousands of NZD. This structure is built for stability, not speed.

- Benefit: Absolute certainty in your biggest expense for easy budgeting and cash flow analysis.

- Risk: Significant break fees if your strategy changes and you need to exit the loan early.

- Best for: Long-term rental properties where consistent, predictable cash flow is king.

Floating Rates: Agility for Active Investors

Opportunity waits for no one. A floating (or variable) rate gives you the agility to strike. You can make huge lump-sum payments or pay off the entire loan without penalty, which is essential for a property flipper. When you sell a renovated property, you want to clear that debt immediately and move on to the next deal. The trade-off is exposure to market shifts in the official cash rate. Your repayments will rise and fall, making cash flow less predictable. When assessing the current mortgage rates NZ has on offer, a floating rate is a calculated risk for a short-term, high-return project.

- Benefit: Maximum flexibility to make extra payments or exit the loan without major fees.

- Risk: Your repayments can rise, potentially squeezing your short-term cash flow.

- Best for: Flipping projects, properties you plan to sell within 1-2 years, or when you’re aggressively paying down debt.

Advanced Tools: Revolving Credit & Offset Mortgages

Once you’re running a real portfolio, you need more sophisticated tools. These structures help your money work harder.

- Revolving Credit: This works like a large business overdraft against your property. It’s the ultimate tool for funding renovations. Draw down cash as you need it for tradies and materials, and pay it back as you can. It gives you incredible control over your project financing.

- Offset Mortgages: This is a powerful strategy for optimising cash flow. By linking your savings or rental income accounts to your mortgage, the balance in those accounts “offsets” the loan principal. You only pay interest on the difference, saving you a fortune and helping you pay down debt faster.

Choosing the right structure isn’t just a box-ticking exercise. It’s a core business decision that directly accelerates your ability to build equity, manage cash flow, and acquire your next asset. Make the choice of a CEO.

How to Compare and Negotiate Rates for Maximum Advantage

The average person accepts the first mortgage rate they’re offered. But you’re not here to be average. As the CEO of your property portfolio, your job is to secure every advantage. That means treating finance as a strategic tool and looking past the advertised numbers to unlock the best possible deal.

Look Beyond the Headline Number

The rate you see online is just marketing. A low headline number can be quickly eroded by a NZ$400 application fee or ongoing charges. A tempting NZ$3,000 cash back offer can mask a higher interest rate that costs you thousands more over the fixed term. Stop focusing on the percentage and start calculating the total cost of the loan. This is the only number that truly matters.

Structuring for Cash Flow: Interest-Only vs. P&I

How you structure your loan is as critical as the rate. For a serious investor, this choice dictates your speed of growth.

- Principal & Interest (P&I): The standard path. You pay down the loan balance and interest, slowly building equity in one property.

- Interest-Only (IO): The investor’s tool for leverage. By only servicing the interest, you maximise your monthly cash flow. This isn’t for lifestyle-it’s capital you deploy to acquire your next asset, letting you scale your portfolio at speed.

The Art of Negotiation

The best mortgage rates nz are never advertised-they are won through negotiation. Never accept the first offer. Leverage is your greatest weapon: get a written offer from a competing lender and make the banks compete for your business. Remember, loyalty rarely gets you the best deal; a sharp strategy does. A great mortgage adviser is a non-negotiable part of your professional team, giving you access to multiple lenders and fighting these battles for you.

Need the strategy to build your portfolio? See how our members do it.

Getting Approved: What Lenders Look for in a Property Investor

Stop chasing advertised rates. Start becoming the applicant banks compete to lend to. Securing the best mortgage rates nz isn’t about luck; it’s about presenting a bulletproof application that screams “low-risk professional.” Lenders are looking for a Property CEO, not a hobbyist landlord. Here’s the playbook to get your finance approved.

Mastering the Loan-to-Value Ratio (LVR)

In New Zealand, LVR rules are a critical gatekeeper for investors. Currently, you may need a deposit of up to 35% for an investment property (a 65% LVR). This directly impacts your borrowing power and how quickly you can scale. Don’t let this stop you. A strategic Property CEO manages their entire portfolio’s LVR, often using equity from existing properties to fund the deposit for the next deal, creating unstoppable momentum.

Navigating Debt-to-Income (DTI) Rules

Your DTI ratio is a simple calculation: your total annual debt repayments divided by your total gross annual income. A high DTI is a red flag for lenders. Common mistakes that inflate it include:

- Keeping high-limit credit cards you don’t use.

- Holding onto personal loans or car finance.

- Not factoring in all sources of income accurately.

Before you apply, attack your DTI. Pay down consumer debt, reduce credit card limits, and present a clean, lean financial profile. This single step can be the difference between a yes and a no.

Proving Serviceability Like a Pro

Can you actually afford the loan, especially if rates rise? That’s serviceability. Banks won’t count 100% of your rental income; they’ll ‘scale’ it back to 75-80% to buffer for vacancies and costs. They will also test your ability to repay the loan at a much higher ‘test rate’. Show them you’re prepared. Clean bank statements are non-negotiable-they want to see consistent savings and no unarranged overdrafts. A strong serviceability profile demonstrates you run your finances like a business and directly improves the mortgage rates nz lenders will offer you.

Ready to build a portfolio that banks love? See how successful investors structure their deals at property-ceo.com.

Secure Your Rate, Then Build Your Empire

You now have the playbook to secure an advantage in the New Zealand property market. You understand how to analyse the factors driving interest rates, make the strategic choice between fixed and floating, and negotiate like a CEO. Securing the best possible mortgage rates nz is a critical first move, but it’s just the opening play.

A low rate saves you money, but a proven system makes you money. It’s the difference between simply owning property and building true financial freedom. Our community of 250+ Property CEOs has completed over NZ$100M in successful property deals using a framework designed for busy professionals just like you.

A low rate is just one part of the wealth equation. To truly build financial freedom, you need a system. Request a Free Strategy Call to learn ours.

Your Questions About NZ Mortgage Rates, Answered

What is a good mortgage rate for an investment property in NZ right now?

A “good” rate isn’t just the lowest number. As a Property CEO, you must analyse the total cost and how it impacts your portfolio’s cashflow. Investor rates are typically 0.25% to 0.75% higher than standard home loan rates. The best deal is one that maximises your return on investment and aligns with your wealth creation strategy. Don’t chase a headline number; secure a rate that makes your deal profitable from day one.

Are NZ mortgage rates expected to go down in 2025?

While many economists predict a potential drop in the Official Cash Rate (OCR) in 2025, waiting is not a strategy. As a Property CEO, you build your empire based on today’s numbers, not tomorrow’s hopes. Any future rate drops are a bonus to your cashflow. The key is to secure a property that works with current mortgage rates nz, ensuring your investment is robust and profitable regardless of market speculation. Control what you can control: the quality of the deal.

Is it better to fix my investment loan for 1 year or 2 years in the current market?

This decision depends entirely on your strategy. Fixing for one year offers flexibility to re-evaluate sooner if rates drop, but it also creates uncertainty. A two-year fix provides stability for your cashflow projections, which is critical when scaling your portfolio. If you’re planning a quick flip, a shorter term might be best. For a long-term buy-and-hold, certainty is more valuable. Analyse your deal’s numbers and choose the term that de-risks your investment.

How much deposit do I need for an investment property in New Zealand?

Banks typically require a larger deposit for investment properties due to Loan-to-Value Ratio (LVR) restrictions. You should aim for a 35% to 40% deposit (e.g., NZ$280,000 on an NZ$800,000 property). However, savvy investors don’t just use cash. We teach proven strategies to leverage existing equity from your home or other properties, allowing you to secure your next deal with significantly less cash upfront and scale your portfolio faster.

Can I still get an interest-only loan as a property investor in NZ?

Yes, interest-only loans are available for investors, but banks have tightened their criteria. They are a powerful tool for maximising cashflow in the short term, freeing up capital to reinvest and scale your portfolio. You’ll need to present a strong financial case, proving you have a clear strategy and the means to repay the principal eventually. Banks want to see a savvy Property CEO with a solid plan, not a speculator.

Does using a mortgage broker actually get me a better interest rate?

A great mortgage broker does more than find a rate; they are a critical part of your financial team. They have access to unadvertised specials and can negotiate with multiple lenders, saving you time and securing superior terms. For a busy professional, this is non-negotiable. They package your application to highlight your strengths as an investor, dramatically increasing your chances of approval and getting the sharpest possible rate for your portfolio.

How does my personal income affect my ability to get an investment loan?

Your personal income is crucial for proving you can service the debt, especially during potential vacant periods. Banks will stress test your salary and expenses to calculate your ability to handle repayments at a higher interest rate. However, a strong deal stands on its own. The projected rental income from the investment property is also a major factor. Your goal is to find a deal so profitable that your personal income becomes a backup, not the primary support.