You’ve done the hard work. You own your own home, you have some equity built up, and now you’re wondering, “What’s next?” For most Kiwis, the journey stops there. But for a select few-the ones who think differently-this is where the real work begins. This is where you start building serious wealth. This guide will give you the step-by-step framework to buy your second NZ property, turning it from a simple purchase into a powerful move towards financial freedom.

Stop Thinking Like a Homeowner, Start Acting Like a Property CEO

Let’s get one thing straight: your second property is not just another house. It’s a strategic asset in your growing empire. The mindset that got you into your first home-saving diligently, paying down the mortgage-is not the mindset that will make you wealthy. To truly scale, you need to stop thinking like a homeowner and start acting like the CEO of your own property portfolio. This single purchase, when executed correctly, can dramatically accelerate your journey to financial independence by creating cashflow, manufacturing equity, and giving you options you never thought possible.

First, Define Your Mission: What’s the Goal for This Property?

A CEO never makes a move without a clear objective. Before you even look at a listing, you must define the mission for this property. What is its job in your portfolio?

- The Buy-and-Hold: This is your workhorse. The goal here is to acquire an asset that generates a consistent, long-term rental income stream. It’s about creating passive cashflow that works for you while you sleep, with capital gains being a long-term bonus.

- The Profitable Flip: This is a cash-injection strategy. You buy an undervalued property, force its appreciation through smart renovations (manufacturing equity), and sell it for a lump-sum profit. This is how you generate significant capital to reinvest and scale faster.

- The Hybrid Model: Think of a holiday home in a desirable location like Queenstown or the Coromandel. It serves as a lifestyle asset for your family but pays for itself (and then some) through short-term holiday rentals when you’re not using it.

Why Your Second Property is the Ultimate Wealth-Building Tool

Buying your second property is the move that separates amateurs from serious investors. It’s where you truly begin to harness the power of leverage to control a larger asset base than you could with your cash alone. Instead of your wealth growing with one property’s capital appreciation, you now have two assets working for you, dramatically accelerating your equity growth. This single step creates options-the ultimate currency of the wealthy. It gives you cashflow, capital gains, and a level of financial security that a 9-to-5 job can never provide.

The Financial Playbook: How to Fund Your Second Property Deal

Forget the myth that you need hundreds of thousands in cash sitting in the bank. Most savvy investors don’t use their own cash to expand their portfolios; they use smart financing strategies and the bank’s money. Let’s break down exactly how to unlock the funds for your next purchase and put your existing assets to work.

Unlocking Your #1 Asset: Using Equity from Your Current Home

The equity in your current home is the most powerful and underutilised financial tool you possess. So, what is usable equity? In simple terms, it’s the difference between your home’s current market value and the mortgage you owe on it. Banks will typically let you borrow up to 80% of your primary home’s value. The gap between that 80% mark and your current mortgage balance is your usable equity. For many Kiwis who have owned their home for a few years, this can be a substantial amount-often more than enough to form the entire deposit for your next investment property without you needing to contribute a single dollar of your own savings.

Navigating the Bank’s Rules: LVR and Deposit Requirements

When you step into the investment space, the rules change. You need to understand the Loan-to-Value Ratio (LVR) restrictions that the Reserve Bank places on investment properties. These rules are tighter than for owner-occupied homes, often requiring a larger deposit (e.g., 35-40%, but you must verify the latest figures). However, as we just discussed, this entire deposit can be funded from the usable equity in your existing home. The second crucial test is proving serviceability. The bank needs to see that you can afford to cover both mortgages, plus your living expenses. They will analyse your income, existing debts, and apply a high “test” interest rate to ensure you can handle repayments even if rates rise.

Structuring Your Loans for Maximum Growth and Flexibility

How you structure your lending is just as important as securing it. Should you fix or float your interest rates? For an investment property, using interest-only loans can be a powerful strategy to maximise your cashflow, freeing up money to pay down other debt or save for your next deal. It’s also a smart strategic move to keep the loans for your home and your investment property separate. This “un-cross-collateralising” gives you greater flexibility and control, preventing the banks from having a claim over your entire portfolio if you decide to sell one property. The right structure can save you thousands and set you up for future growth. Confused by the numbers? Let’s create a clear financial strategy for you.

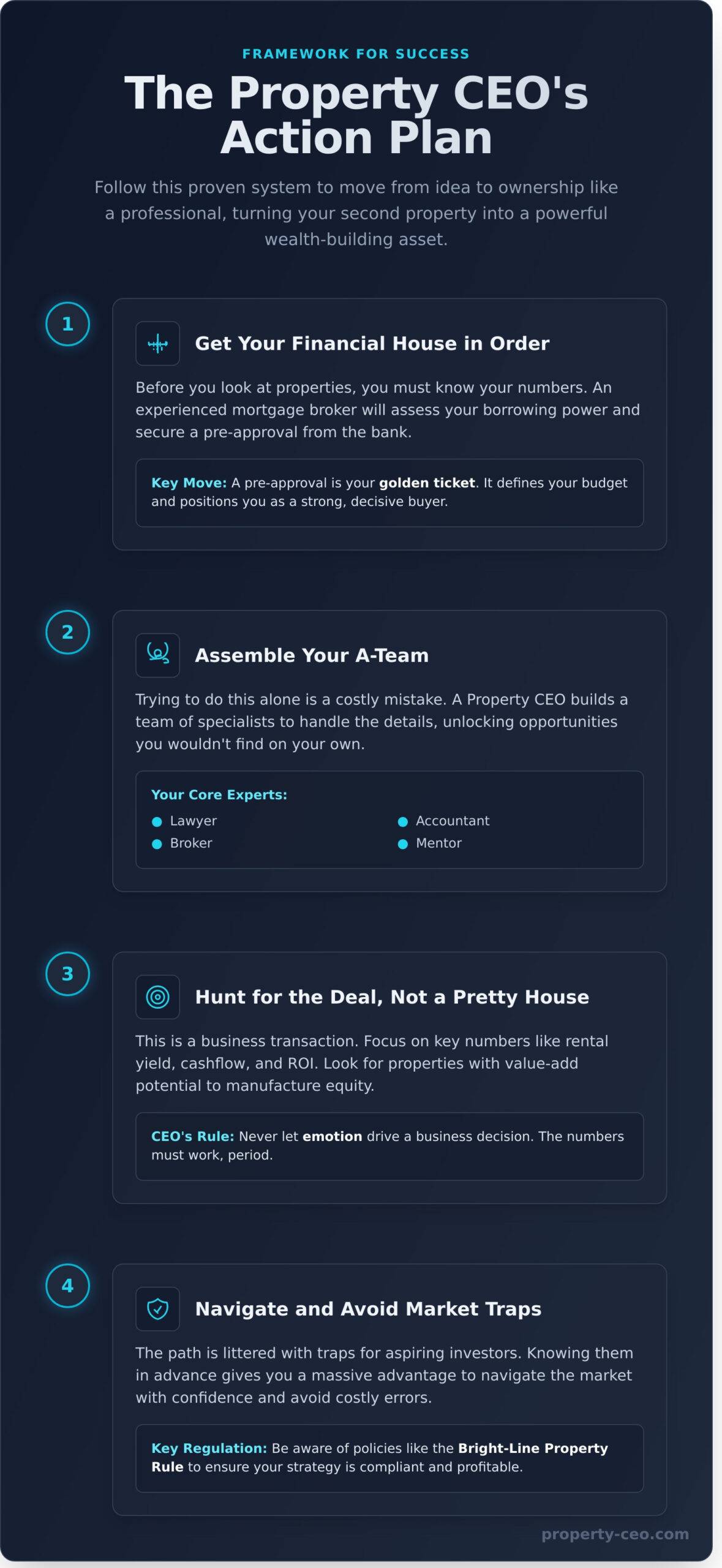

Your 4-Step Action Plan to Secure Your Next Investment

Success in property isn’t about luck; it’s about following a proven framework. This is the exact system our members use to confidently buy investment properties without the stress and guesswork that paralyses most people. Follow these steps to move from idea to ownership like a professional.

Step 1: Get Your Financial House in Order

Before you even think about looking at properties, you must know your numbers. The first call you make should be to an experienced mortgage broker who understands property investment. They will assess your true borrowing power and help you secure a pre-approval from the bank. A pre-approval is your golden ticket. It tells you your exact budget and transforms you from a window shopper into a strong, confident buyer who can move decisively when the right deal appears.

Step 2: Assemble Your Professional A-Team

Trying to do this alone is the biggest mistake you can make. A Property CEO builds a team of experts to handle the details. You need more than just a real estate agent. You need a sharp lawyer who specialises in property, an investor-savvy accountant who can advise on ownership structures and tax, and ideally, a mentor who has been there and done it. This A-team is your defence against costly mistakes and your key to unlocking opportunities you wouldn’t find on your own.

Step 3: Hunt for the Deal, Not Just a Pretty House

This is a business transaction, not a search for your forever home. You must learn the key numbers that define a good investment property, such as rental yield, cashflow, and return on investment. Focus your search on locations with strong growth drivers and look for properties with value-add potential-an opportunity to manufacture equity through renovation or subdivision. Never let emotion drive a business decision. The numbers must work, period.

Avoiding Common Second-Property Traps in New Zealand

The path to building a property portfolio is littered with traps that catch aspiring investors. Knowing what these are in advance gives you a massive advantage and allows you to navigate the market with confidence, avoiding the costly errors that force others to give up.

The Bright-Line Property Rule: Don’t Get Caught Out

This is the big one. The bright-line property rule is essentially a capital gains tax that applies if you sell a residential investment property within a certain timeframe (currently 10 years for existing homes, but you must verify the latest legislation). Understanding how this rule works and how it applies to your situation is non-negotiable. It will influence your investment strategy-whether you plan to hold long-term or flip-and you must plan for the potential tax implications from day one to avoid a nasty surprise from the IRD.

Forgetting the ‘Hidden’ Costs of Ownership

Your mortgage repayment is just the beginning. Novice investors often get into trouble by failing to budget for all the other costs of ownership. You must factor in council rates, property insurance, and a realistic budget for ongoing maintenance and repairs. If it’s a rental property, you also need to account for potential vacancy periods between tenants. These “hidden” costs directly impact your true cashflow and profitability, and ignoring them can turn a promising investment into a financial drain.

FAQs

How much equity do I need to buy a second home in NZ?

You need enough “usable equity” in your current home to cover the deposit required for the second property. Banks typically let you borrow up to 80% of your home’s value. The amount between that 80% threshold and your current mortgage balance is your usable equity. For an investment property, the deposit requirement is often around 35-40%.

Can I use my KiwiSaver for a second house?

No, KiwiSaver withdrawals are generally restricted to purchasing your first home. It cannot be used for a second home or an investment property.

How does the bank calculate if I can afford two mortgages?

The bank assesses your “serviceability.” They add up all your income (including potential rent from the new property, usually scaled back to 75-80%) and subtract all your expenses and debt repayments (including both mortgages calculated at a higher “test” interest rate). You must have enough surplus income to meet their criteria.

What is the bright-line test and does it apply to me?

The bright-line property rule taxes the profit made from selling a residential property within a specific period. It applies to investment properties, not your main family home. The timeframe has changed over the years, so it’s critical to get professional accounting advice on how it applies to your specific purchase date and situation.

Is it better to buy a new build or an existing house as an investment?

Both have pros and cons. New builds often have lower deposit requirements (LVR advantages) and lower maintenance costs, but may have a lower rental yield initially. Existing houses can offer better value-add opportunities and potentially higher yields, but may come with more maintenance surprises. The best choice depends on your strategy and risk tolerance.

Should I sell my current home to buy another, or keep it as a rental?

If you can financially service the debt, keeping your current home as your first rental is often a fantastic way to start your portfolio. You’ve already done the hard work of paying down the mortgage, and it allows you to start building your asset base immediately. This is a core strategy for becoming a Property CEO.

You have the ambition. You have an asset ready to be leveraged. The only thing missing is the right strategy and a clear plan of action. Stop trading your time for money and start making your money work for you. Join a community of over 250 active Kiwi investors who are already on this path. Our members have successfully completed over $100M in property deals using the proven, step-by-step system designed for busy professionals like you. Ready to make your second property a reality? Book a free, no-obligation Strategy Call.