You’ve found the deal. You’ve run the numbers. You’re ready to scale your portfolio and stop trading time for money. But then, the doubt creeps in. Will the bank actually approve the funding? For many ambitious Kiwi investors, understanding the debt to income ratio NZ lenders use is the final, confusing hurdle between them and their next property. This uncertainty is the single biggest barrier to building real wealth, leaving you worried that your existing debt will kill the opportunity before it even begins.

Forget the fear and confusion. This guide is your playbook to becoming the CEO of your financial future. We’re pulling back the curtain to show you exactly how banks calculate your borrowing power and what you can do about it. You will learn the proven, actionable strategies to manage your DTI, speak to lenders with total confidence, and unlock the funding you need to build your empire. It’s time to stop waiting for permission and start creating your own financial freedom.

What is DTI and Why Does it Matter to a Property CEO?

Forget the standard definition of Debt-to-Income Ratio (DTI). A typical home buyer sees it as a one-time hurdle to clear for their family home. But you’re not a typical home buyer. You are a Property CEO, and for you, DTI isn’t a hurdle-it’s a critical health check for your entire property business.

Most investors get stuck after one or two properties because they don’t treat their portfolio like a business. They don’t strategically manage their numbers. Understanding the debt to income ratio nz rules is the first step, but mastering your personal DTI is how you unlock serious growth. It’s the difference between being a passive landlord and building a wealth-generating empire.

While the basic formula is simple-as explained in this overview of what a debt-to-income ratio is-its application for a Property CEO is far more strategic. It’s a direct measure of your capacity to leverage debt to acquire more cash-flowing assets.

DTI: Your Key to Unlocking Leverage

To a lender, a low DTI signals one thing: financial stability. It proves you can comfortably manage your existing commitments, making you a low-risk, high-value client. This isn’t a barrier designed to stop you; it’s a metric you must master. A well-managed DTI is your license to scale. It gives you the power to act decisively and secure funding when a high-profit opportunity appears, leaving slower, less-prepared investors behind.

The ‘Why’ Behind the Rules: RBNZ and Financial Stability

The Reserve Bank of NZ (RBNZ) didn’t introduce these rules to stop your progress. Their goal is to ensure the stability of the entire financial system by preventing an overheated housing market. These DTI restrictions protect both the banks and borrowers from the risks of over-leveraging. A smart Property CEO doesn’t see this as a random roadblock. They see it as a predictable rule of the game-one they can build a winning strategy around.

How NZ Banks Calculate Your DTI: A Step-by-Step Breakdown for Investors

Stop guessing. To build your property empire, you need to think like a lender. The bank’s calculation for your Debt to Income Ratio (DTI) is simple on the surface but ruthless in its detail. It’s the gatekeeper to your next deal.

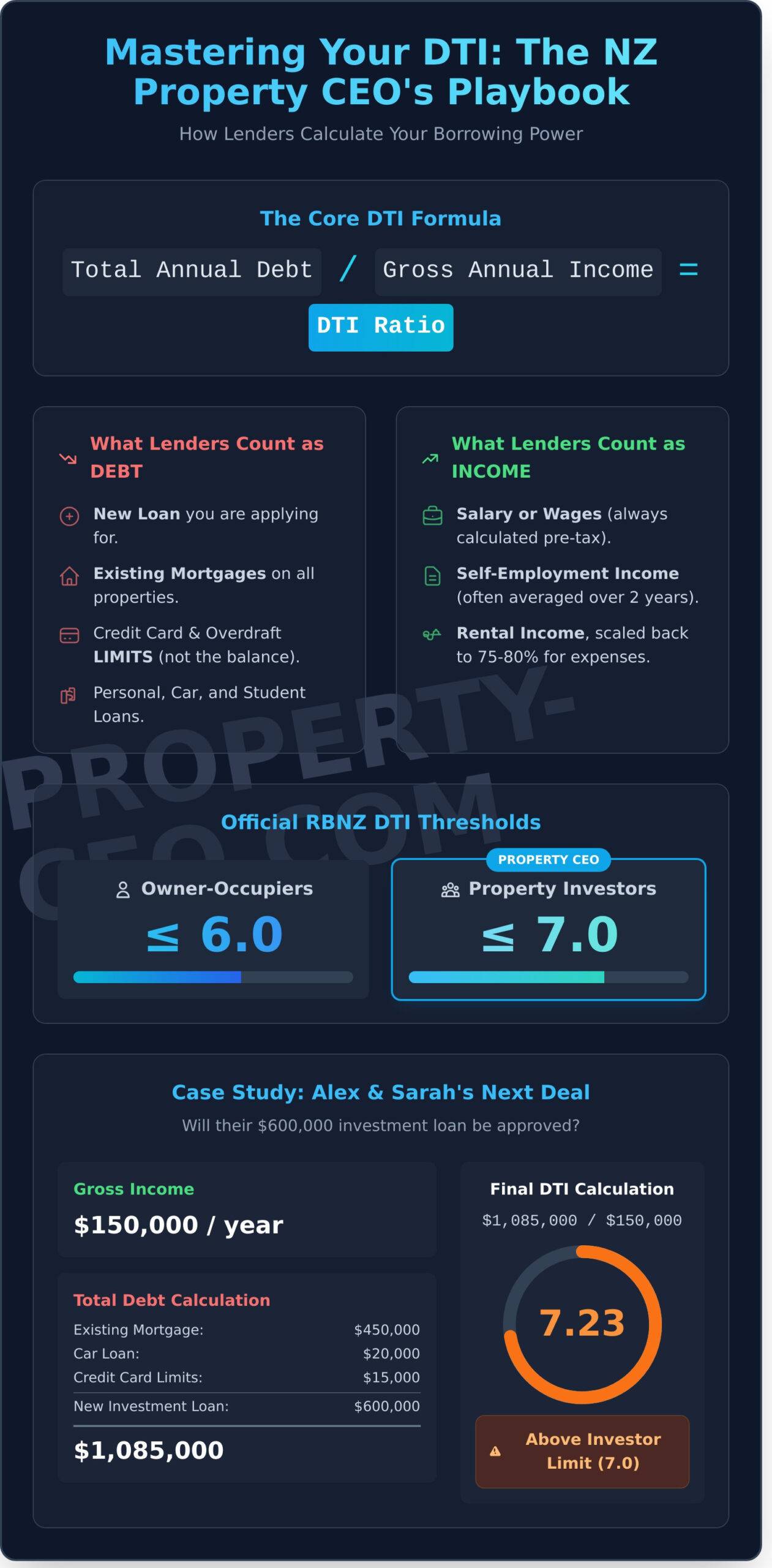

Here’s the core formula they use:

Total Annual Debt / Gross Annual Income = DTI Ratio

The difference between getting approved and getting rejected lies in what the bank includes in ‘debt’ and ‘income’. Let’s break down the playbook so you can get ahead.

What Counts as ‘Debt’ in the Bank’s Eyes?

Lenders assess your total potential liability, not just what you owe today. This is a critical mistake many aspiring Property CEOs make. They see everything, and they are always conservative. Your total debt includes:

- The new loan you are applying for (this is always included).

- Existing mortgages on your home and any other investment properties.

- Credit card and overdraft limits, not just your current balance. A $20,000 limit counts as a $20,000 debt, even if the balance is zero.

- Personal loans, car loans, and student loans.

- Hire purchases and any buy-now-pay-later (BNPL) facilities like Afterpay or Zip.

How to Calculate Your ‘Gross Income’ for Lending

Your gross income is the engine of your portfolio, but banks only count what they can verify as stable and consistent. Under the official RBNZ DTI rules, this calculation is now a formal part of the lending framework. Banks will typically consider:

- Your primary salary or wages (always calculated before tax).

- Self-employment income, often averaged over the past two years to prove stability.

- Rental income from your existing properties, but it’s usually scaled back to 75-80% to account for vacancies and expenses.

- Boarder or flatmate income, provided it is declared and has a history of consistency.

Putting it Together: A Worked Example

Meet Alex and Sarah, a busy professional couple ready to stop trading time for money by purchasing their first investment property.

- Gross Combined Income: $150,000 per year.

- Their Existing Debts:

- Existing Home Mortgage: $450,000

- Car Loan: $20,000

- Combined Credit Card Limits: $15,000

- New Investment Loan Sought: $600,000

Total Debt Calculation: $450,000 (mortgage) + $20,000 (car) + $15,000 (cards) + $600,000 (new loan) = $1,085,000

Their DTI Calculation: $1,085,000 / $150,000 = 7.23

This DTI of 7.23 is above the typical investor cap of 7 for many banks. Without a clear strategy to manage this, they would be declined. Understanding your precise debt to income ratio nz is the first step to overcoming these funding roadblocks and building real wealth.

The Official RBNZ DTI Rules: Know the Playing Field

To scale your property portfolio, you need to stop seeing regulations as roadblocks and start seeing them as the rules of the game. Once you know the playbook, you can strategise your way to the top. The Reserve Bank of New Zealand (RBNZ) sets these rules not as a direct law for you, but as a lending standard for the banks. This is a critical distinction-it means the system has built-in flexibility for investors who present a compelling case.

Understanding the official debt to income ratio NZ framework is the first step to mastering it.

The Key DTI Thresholds: Owner-Occupier vs. Investor

The RBNZ has set two distinct tiers for DTI limits. Think of these as the baseline qualifications:

- Owner-Occupiers: Your DTI ratio must generally be 6 or lower. This means your total debt can be no more than six times your gross annual income.

- Property Investors: You get more leverage. Your DTI ratio limit is generally 7 or lower.

Why the extra point for investors? Banks recognise that a well-chosen investment property generates its own rental income, directly contributing to debt servicing and lowering the lender’s overall risk.

Understanding the Bank ‘Speed Limit’

This is where the real opportunity lies for a savvy Property CEO. The DTI thresholds aren’t a brick wall. The RBNZ allows banks a ‘speed limit’-a specific portion of their new lending that can go to borrowers who exceed the standard DTI caps.

For investors, this means banks can allocate up to 20% of their new lending to borrowers with a DTI ratio above 7. This isn’t a loophole; it’s a deliberate allowance for high-quality applications. A strong portfolio, a clear strategy, and a professional application can position you to access this funding and outpace the competition.

Important Exemptions to DTI Rules

Beyond the speed limit, certain activities are completely exempt from DTI restrictions. These are powerful strategic tools for growing your portfolio without being constrained.

- New Builds: Construction loans for new-build properties are currently exempt, encouraging development and creating a massive opportunity for investors.

- Refinancing: You can refinance an existing mortgage with a new lender without being subject to DTI tests, provided you are not increasing your total loan amount.

- Porting a Mortgage: Moving an existing mortgage from one property to another is also exempt.

Knowing these rules is the first step. The next is leveraging them to build your property empire faster than you thought possible. Turn these rules into your advantage. Let’s build a strategy.

How to Improve Your DTI Ratio and Maximise Borrowing Power

Stop seeing your DTI as a fixed roadblock. Start treating it like a key performance indicator you can actively manage. A Property CEO doesn’t wait for the bank to say yes; they engineer their financial position to make ‘no’ an impossible answer. Taking control of your debt to income ratio nz is about a strategic, two-pronged attack: systematically reducing your liabilities while actively maximising your verifiable income.

This isn’t about extreme sacrifice. It’s about making smart, decisive moves that give you the leverage to scale your property portfolio. Here is the playbook busy professionals use to get their funding applications over the line.

Attack Your Debts: The Quickest Wins for Your DTI

Every dollar of personal debt you carry is a handbrake on your investing ambitions. Lenders scrutinise every liability, so a strategic clean-up before you apply is non-negotiable. Focus on these high-impact actions:

- Consolidate and Conquer: Roll high-interest credit card debt or personal loans into a single, lower-rate loan. This immediately reduces your monthly debt servicing costs, which is a massive win for your DTI calculation.

- Cut Your Credit Limits: Paid off a credit card? Don’t just leave it open. Lenders assess your total available credit, not just your balance. Call the bank and have the limit reduced or close the account entirely.

- Eliminate Nuisance Debt: That lingering hire purchase on the TV or the Afterpay balance must go. These small, consistent payments add up and signal to lenders a reliance on short-term credit.

- Liquidate Underperforming Assets: The boat, the jet ski, or the second car that barely gets used? If it has a loan against it, consider selling it. This is often the fastest way to wipe out a significant liability and transform your borrowing power.

Engineer Your Income: Making Every Dollar Count

Your income is only as good as your ability to prove it. Lenders won’t take your word for it; they need clean, consistent, and verifiable proof. Structure your income to present the strongest possible case:

- Document Everything: Ensure all income sources, from your salary and bonuses to rental income and side-hustle profits, are properly documented with tax returns and bank statements.

- Time Your Strike: If a pay rise or promotion is just around the corner, it can be strategic to wait. Applying with a higher base salary provides a powerful boost to your application.

- Optimise Rental Income: Make sure your existing properties are achieving market rent and that this is clearly reflected in your financial statements. A signed tenancy agreement is gold.

Leverage a Power Team: The Mortgage Broker Advantage

Trying to navigate the complex DTI policies of different banks on your own is like flying blind. A savvy, investor-focused mortgage broker is an essential part of your professional team. They don’t just find rates; they provide a strategic advantage. A good broker knows which lenders have a greater appetite for investor applications, how they each interpret the debt to income ratio nz rules, and how to structure your application to highlight your strengths. This inside knowledge can be the difference between a fast approval and a frustrating decline.

Mastering your DTI is a core skill for any serious investor. It’s this CEO-level thinking that allows our members at Property-CEO to build wealth without being held back by bank restrictions.

Master Your DTI and Build Your Property Empire

Understanding the Debt to Income (DTI) ratio isn’t just about compliance; it’s about taking control of your financial future. You now have the playbook: you know how the banks calculate your borrowing power, the rules of the game set by the RBNZ, and the exact strategies to improve your position. Mastering your debt to income ratio nz is the critical lever that separates a stalled portfolio from one that scales with speed and precision.

But knowledge without action is just theory. It’s time to stop trading time for money and start building a real asset base. Don’t let bank limitations define the size of your ambition. It’s time to become the CEO of your own property business.

Ready to build your property empire? Request a Free Strategy Call. Learn the proven system behind $100M+ in property deals and get guidance from experienced investors who’ve done the real work. You’ll join a community of 250+ active investors who’ve got your back. Your next level of financial freedom is one strategic conversation away.

Frequently Asked Questions About Debt to Income Ratio NZ

How is Debt-to-Income Ratio (DTI) different from Loan-to-Value Ratio (LVR)?

Think of it this way: LVR is about your equity, and DTI is about your cash flow. LVR measures your deposit against the property’s value-it’s your skin in the game. DTI, however, measures your total income against your total debt payments. It’s the bank’s way of asking, “Can you actually afford the repayments?” As a Property CEO, you must master both metrics to scale your portfolio and unlock more funding.

How do New Zealand banks treat rental income when calculating my DTI for an investment property?

New Zealand banks don’t count 100% of your gross rental income. They “scale” it, typically using only 65% to 80% in their calculations to account for expenses like vacancies, rates, and maintenance. This is a critical factor in your debt to income ratio NZ calculation. To get ahead, you need a strategy that focuses on high-yield properties to ensure your scaled income still provides powerful servicing ability for your next purchase.

Can I still get an investment property loan if my DTI is higher than 7?

Yes, it’s possible, but it requires a strategic approach. While the Reserve Bank has set restrictions, banks have a small allocation for high-DTI lending. To access this, your application must be exceptional. This means having a large deposit, a clean credit history, and a strong relationship with your lender or broker. It’s not about finding loopholes; it’s about presenting yourself as a low-risk, professional investor who has all their ducks in a row.

Do DTI rules apply if I’m refinancing my existing investment property mortgage?

Absolutely. If your refinance involves increasing your total lending-for example, pulling out equity to fund your next deal-the new DTI rules will apply. The bank assesses this as new borrowing and will run the numbers. A simple rate refix might not trigger the same scrutiny, but if you’re using refinancing as a tool to grow your empire, you must plan for your DTI to be a key part of that conversation.

Does using a company or trust to buy property change how DTI is calculated?

Using a company or trust doesn’t create a DTI loophole. Banks look past the structure to the individuals guaranteeing the loan-that’s you. Your personal income and existing debts will still be the core of the serviceability assessment. While these structures are essential for asset protection and tax efficiency, they don’t change the fundamental calculation of your ability to service the debt, which remains the number one factor for the bank.

Will my KiwiSaver balance help my DTI ratio?

No, your KiwiSaver balance does not directly improve your DTI ratio. DTI is a measure of your income versus your debt obligations; KiwiSaver is a capital asset, not an income stream. While using your KiwiSaver for a larger deposit can reduce the loan you need-which lowers your debt payments and therefore helps your DTI-the balance itself isn’t counted as income. Focus on boosting cash flow to make a real impact on your DTI.